Losing a loved one is difficult. Navigating the legal complexities that follow can feel overwhelming. But in South Carolina, if the estate is relatively small, a simpler path exists: the small estate affidavit. This guide provides clear, step-by-step instructions to help you navigate this process.

Understanding South Carolina's Small Estate Affidavit

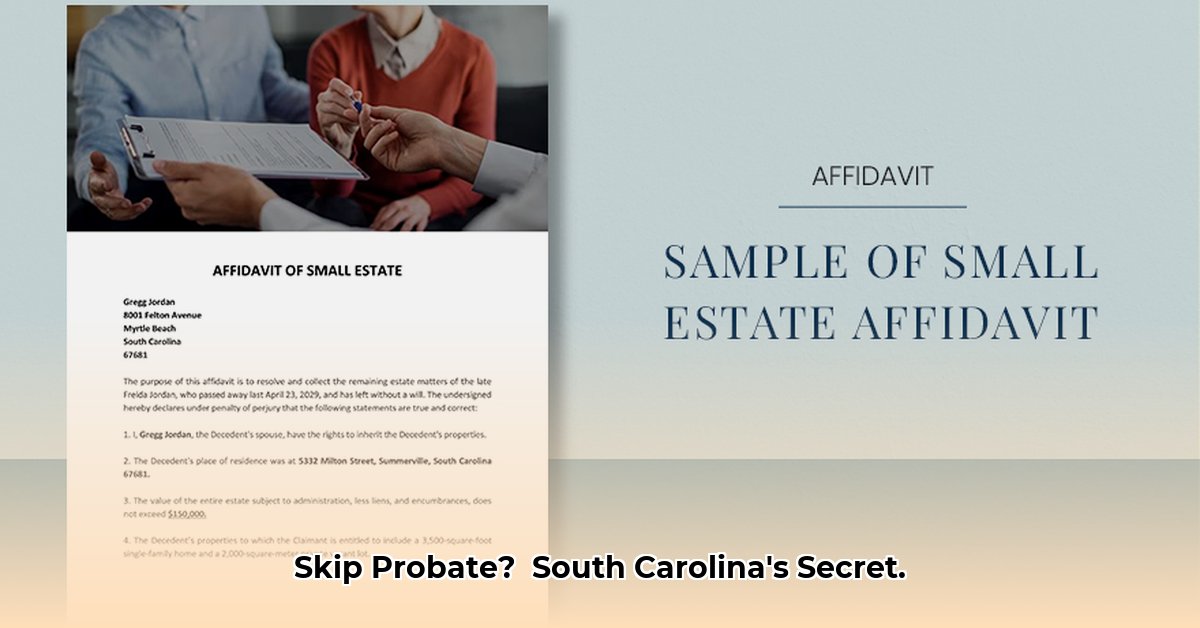

A South Carolina small estate affidavit is a legal document that allows you to bypass the traditional probate process, saving you time, money, and stress. It's designed for estates valued at $50,000 or less (after debts and taxes, excluding the home's value). It streamlines the transfer of assets to rightful heirs. Think of it as a streamlined, less complicated alternative to full probate.

Who Can Use a South Carolina Small Estate Affidavit?

This method isn't suitable for every situation. Consider these factors:

- Estate Value: The total estate value (after expenses) must be under the $50,000 limit. Values slightly above might still qualify, but require legal review.

- Asset Type: This process works best for straightforward assets like bank accounts and simple investments. Complex assets, such as businesses or large properties, typically necessitate full probate.

- Heirs: Clearly defined heirs simplify the process. Disputes or numerous heirs may require a more comprehensive approach.

Step-by-Step Guide to Filing a South Carolina Small Estate Affidavit

Let's break down the process. It's easier than you might think!

Step 1: Gather Necessary Documents Thorough preparation is key. Collect proof of asset ownership and heirship. This includes death certificates, bank statements, investment records, and any documentation showing ownership and inheritance. Accuracy here prevents delays.

Step 2: Complete the Affidavit Form Accurately complete the official South Carolina small estate affidavit form. While you can attempt this yourself, seeking assistance from someone experienced with legal documents is highly recommended. Errors can invalidate the process.

Step 3: File the Affidavit with the Court Submit the completed affidavit to the Probate Court in the county where your loved one resided. Follow the court's instructions meticulously.

Step 4: Pay Court Fees Court fees apply, but are generally lower than traditional probate costs. Confirm the exact amounts with the court beforehand.

Step 5: Claim the Assets Once the court approves your affidavit, you can distribute the assets according to the information provided.

Advantages and Disadvantages: Weighing Your Options

Consider both the benefits and drawbacks before proceeding:

| Advantages | Disadvantages |

|---|---|

| Significantly cheaper than traditional probate | Only suitable for estates below the value limit. |

| Faster than traditional probate | Requires precise accuracy and attention to detail. |

| Less stressful for grieving families | Might not be suitable for all assets or heir situations. |

| Simpler and less complex | Risk of rejection if requirements aren't met. |

| Reduced emotional burden | May necessitate professional legal guidance. |

When to Seek Professional Legal Help

While simpler than full probate, seeking legal advice before starting is highly recommended, especially in complex situations. Unusual assets, potential disputes among heirs, or uncertainty about any aspect of the process warrants consulting a lawyer. They ensure compliance and prevent issues. "A lawyer can help navigate the complexities and ensure a smooth and successful process," says Sarah Miller, Esq., Estate Attorney at Miller & Associates Law Firm.

Remember: This guide provides general information; it's not a substitute for legal advice. Consult a legal professional for personalized guidance. Prioritizing the memory of your loved one is key, and making sure the legal aspects are correct helps with that.